For well over a decade, before the recent jump in rates, savings accounts were dead money. The central bank had announced a further 25 basis point interest rate hike on Wednesday June 3 and indicated that rate increases may be paused imminently. Fed Chairman Jerome Powell suggested that it was too early to cut rates and will likely pause the rest of 2023.

With interest rates rising and regional banks suffering, major banks are offering higher-yielding offerings but the highest rates available to savers aren’t coming from traditional financial firms or credit unions, but rather from companies in and around Silicon Valley.

Apple recently launched a high-yield savings account administered by Goldman Sachs, offering 4.15% APY on your savings. Apple Savings could be a good fit for Apple Card users. Unlike many other savings accounts, you’ll need to have an Apple Card in order to access this account. While that amount is more than 10 times the national average APY, it’s not the highest rate available in today’s climate — some accounts earn APYs of 5.00% and a few are starting to brush up against 6.00% APY.

But I’m not familiar or had relationships with a lot of these banks (online and brick & mortar) like Synchrony, Bask Bank, Mango Money, etc. – see Bank Rate website for the latest rates.

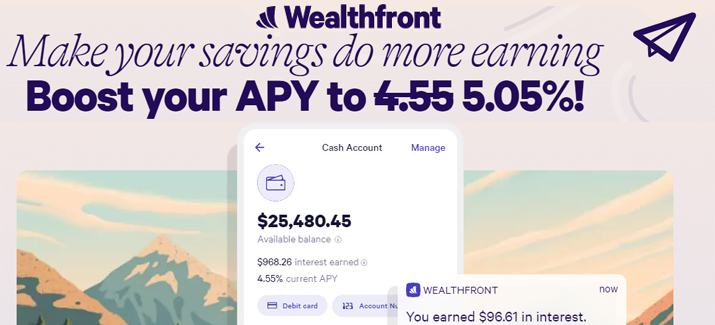

Wealthfront Cash Account

My adult kids have savings accounts at Capital One (360 Performance Savings) yielding at more than 3.75% APY. However, I’ve been sitting any extra cash and earning a much higher interest since May 2019 at Wealthfront. Starting May 5, their new APY is 4.55% (they match the Fed rate increases like clockwork).

As with almost all online savings accounts, you can move your money electronically between financial institutions instantly and they’re settled within 3 to 5 business days. But I have not moved any money out of Wealthfront since 2019 – only inflows 🙂

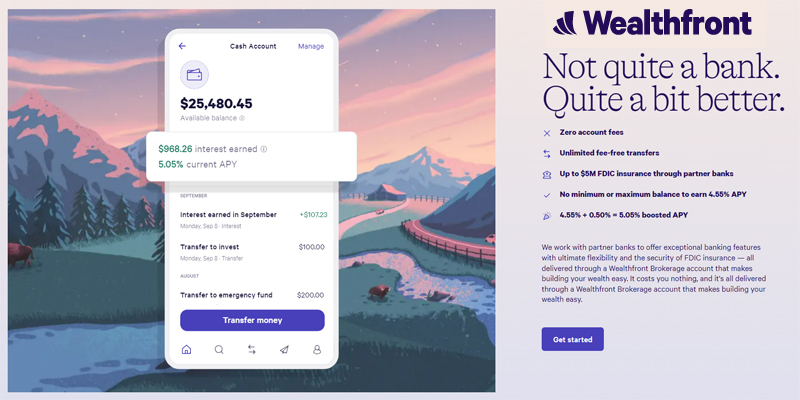

One unique feature is that your money is protected up to $5 million in FDIC insurance ($10 million for joint accounts), both offered through their partner banks. Compare this to $250,000 for traditional banks. How do they do it? Typically, banks provide $250K in FDIC insurance. To provide you with $5 million in FDIC insurance, Wealthfront automatically allocate your money across up to twenty unaffiliated partner banks. This allocation happens behind the scenes and doesn’t impact how you access your money through your Wealthfront Cash Account or debit card. Read the full details here for yourself.

Still have some cash earning less in a traditional bank? Consider moving it to a Wealthfront Cash Account where you can earn safely and stay ready to invest. The Wealthfront Cash Account combines checking and savings features in one account. You can deposit your paycheck, pay bills, use a debit card, and earn interest on your entire balance, no matter the amount. No overdraft fees, no transfer fees, no minimum balance fees.

The Annual Percentage Yield (APY) for the Cash Account may change at any time, before or after the Cash Account is opened.

LIMITED TIME OFFER

Boost your APY to 5.05%! That’s an extra 0.50% interest for 3 months!

When you open and fund a Wealthfront Cash Account as a new client, you and your friend will both get a boosted 5.05% APY for 3 months. And after that, you’ll still enjoy our industry-leading 4.55% APY. There’s no minimum balance requirement, so all you have to do is sit back and watch that interest add up.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.