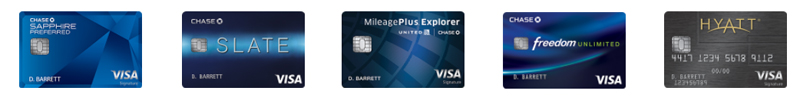

As you start owning or applying to more credit cards, you’ll undoubtedly run across the Chase ‘5/24’ Rule (nothing official from Chase). Basically, Chase is trying to avoid churning and has instituted a hard rule of denying certain Chase credit card applications for people that have signed up for 5 or more new credit cards in the past 24 months. Chase 5/24 rule applies to the most personal Chase cards and some Business cards. These include (not comprehensive list):

- Chase Freedom

- Chase Freedom Unlimited

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Slate

- Chase Ink Cash

- Chase Ink Plus

- Chase Ink Preferred

- Chase Southwest Plus

- Chase Southwest Premier

- Chase Marriott Premier

- Chase United MileagePlus Club Card

- Chase United MileagePlus Explorer

Chase will deny credit card applications if you have signed up for 5 new credit cards from any bank in the past 2 years. Includes credit cards where you’re considered an authorized or secondary user.

What To Do

- Prioritize which Chase cards you want to get approved for if you haven’t hit the Chase 5/24 Rule yet.

- If you have been targeted for a Chase credit card, it is less likely Chase will apply the 5/24 rule.

- Whether you’re subject to the Chase 5/24 Rule or not, remove yourself as an secondary or authorized user on any credit cards approved in the last 24 months.

If you’ve been denied a Personal Chase credit card application, try applying for the Business version if it is available. Or you can apply for cards from other issuers like American Express, Citibank, or Barclays USA.

For a comprehensive discussion, full list of cards affected, and additional gems on this topic, please check out this awesome post from Doctor of Credit.